Background

Days-Sales-in-Inventory (DSI) measures the number of days it takes for a company to turn its inventory into sales. DSI is computed as follows: (Ending inventory/Cost of goods sold during the period) X number of days in the period. If the DSI number grows over time it indicates that a company's inventory turnover is decreasing because it is taking longer periods of time for a company to turn its inventory into sales. A continuously growing DSI can indicate one or more of the following: inventory mismanagement, potential inventory impairment, OR an overstatement of inventories to inflate profits

Second quarter financial results

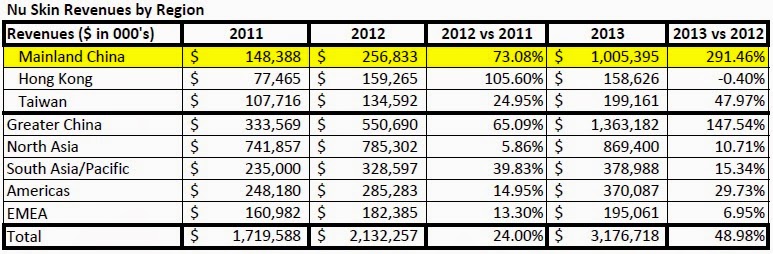

In the second quarter of 2014, Nu Skin reported $650.0 million of revenues compared to $671.3 million in the second quarter of 2013. Its revenues were $50 million below the $700 million of guidance it gave investors on May 6, 2014. During the second quarter earnings call, CFO Ritch N. Wood said:

So while we reported gross margin for the quarter 76% without this $50 million inventory charge, gross margin would have been a solid 83.7% that's compared to 83.4% in the prior year.

Ritch Wood was quick to offer up pro forma numbers purporting that Nu Skin's gross profit margins would have been higher excluding the $50 million inventory impairment charge. However, he did not offer the flipside of those same pro forma numbers showing that gross inventory levels continued to grow larger excluding the same impairment charge. Without the impairment charge, inventories would have increased to a record $439.7 million in second quarter of 2014 compared to $410.7 million in the previous first quarter. More significantly, days-sales-in-inventory (DSI) would have grown 158% higher to a record 377 days in the second quarter of 2014 versus 146 days in the comparable second quarter of 2013.

Even if we take into account the $50 million inventory impairment, at the end of the second quarter of 2014 Nu Skin carried enough unimpaired inventories to fulfill 335 days of sales versus only 146 days in the comparable second quarter of 2013. Its days-sales-in-inventory was 129% higher in 2014 compared to 2013.

Note: Days-sales-in-inventory (DSI) excluding the effect of the inventory impairment is calculated as follows: [Ending inventory/ (cost of goods sold - impairment charge)] X 91 days. Cost of goods sold - impairment charge = cost of goods sold for unimpaired inventory. Ending inventory reported by Nu Skin is the same as the carrying value of unimpaired inventory.

Risk of reduced gross margins and another material inventory impairment charge

After inventory is impaired, it still physically exists until it is disposed of by the company. It is merely carried on a company's books at its market value. Initially, a company records its inventory at cost. When the value of inventory declines below cost, the company makes the following entries on its books: (1) increase cost of goods sold and (2) increase inventory reserve account. The inventory reserve account is a "contra-asset account" and it reduces the gross value of inventory reported on a company's balance sheet. The inventory value reported on a company's balance sheet is the net of its gross inventory (at cost) less its inventory reserve account (impairment).

In the second quarter 2014, 10-Q report page 14, Nu Skin disclosed "adjustments" to its inventory "carrying value" but did not make it clear whether the impaired inventory was still on hand for future sale (albeit to recover costs) or was actually discarded (trashed as unsaleable):

14. ADJUSTMENT TO INVENTORY

During the second quarter of 2014, the Company made a determination to adjust its inventory carrying value. Heightened media and regulatory scrutiny in Mainland China in the first part of 2014, and the voluntary actions the Company took in response to such scrutiny, had a negative impact on the size of the Company's limited-time offer in June, which significantly reduced its expectations for plans to sell TR90 in a limited-time offer later in 2014 or the beginning of 2015. This resulted in a $50 million write-down of estimated surplus inventory in Mainland China. Total adjustments to the Company's inventory carrying value as of June 30, 2014 and December 31, 2013 were $58.0 million and $5.9 million, respectively. [Emphasis added.]

If Nu Skin still intends to sell its impaired inventory to recover costs, the age of its other unimpaired inventory will invariably grow longer. Even if we assume that Nu Skin trashed $50 million of impaired inventory as unsaleable, the days-sales-in-inventory on its remaining unimpaired inventories will likely continue to grow since it is carrying an excessive level of merchandise while it is projecting significant declines in second half revenues.

Nu Skin projected third quarter 2014 revenues in the range of $620 million to $640 million compared to $908.3 million revenues in same quarter of 2013. It projected fourth quarter 2014 revenues in the range of $650 million to $675 million compared to $1.056 billion in the same quarter of 2013. Its revenue guidance amounts to a decline in second half 2014 revenues of 33% to 35%. At the beginning of the second half of 2014, Nu Skin carried $389.7 million of inventories compared to $178.2 million at the beginning of the second half of 2013. It carried 118.7% more inventories going into the second half 2014. Therefore, it appears that Nu Skin is excessively overstocked at a time when its revenues are expected to significantly decline. That's a significant red flag.

Written by:

Sam E. Antar

Disclosure

I am a convicted felon and a former CPA. As the CFO of Crazy Eddie, I helped mastermind one of the largest securities frauds uncovered during the 1980's. Today, I advise federal and state law enforcement agencies about white-collar crime and train them to identify and catch the crooks. Often, I refer cases to them as an independent whistleblower. I teach about white-collar crime for government entities, businesses, professional organizations, and colleges and universities. I perform forensic accounting services for law firms and other clients.

I do not own any Nu Skin securities long or short.

.jpg)